In a significant milestone for the tech industry, Nvidia has briefly surpassed a market capitalization of $3 trillion, driven by the burgeoning demand for artificial intelligence (AI) technologies. This landmark achievement places Nvidia ahead of Apple, positioning it as the second most valuable company globally. Here’s a detailed examination of Nvidia's rise, the driving forces behind its success, and the implications for the broader market.

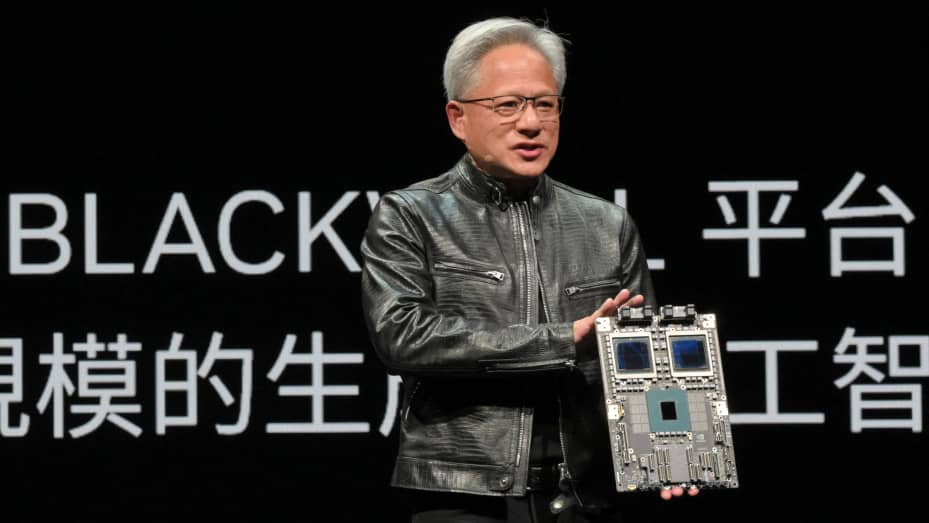

Nvidia's rise to a $3 trillion market cap is a testament to its strategic positioning within the AI and semiconductor sectors. Founded in 1993, Nvidia has evolved from a niche graphics processing unit (GPU) manufacturer to a dominant player in the AI revolution. The company's GPUs are integral to the training and deployment of AI models, making Nvidia an indispensable part of the tech infrastructure that underpins AI advancements.

The AI boom has been the primary catalyst for Nvidia's unprecedented market valuation. With AI applications expanding across various industries—from healthcare and finance to entertainment and autonomous driving—the demand for high-performance computing solutions has surged. Nvidia's GPUs are known for their ability to handle complex computations efficiently, making them the preferred choice for AI workloads.

In recent years, Nvidia has invested heavily in AI research and development, further solidifying its market leadership. The company's AI platforms, such as CUDA (Compute Unified Device Architecture) and its data center products, have become critical tools for AI researchers and developers worldwide. These investments have paid off handsomely, propelling Nvidia's stock to new heights and culminating in its $3 trillion market cap milestone.

Nvidia's market cap surge has had significant implications for its competitors and the broader tech market. The company’s leapfrogging of Apple as the second most valuable company underscores the shifting dynamics within the tech industry. Apple, long regarded as the epitome of innovation and market leadership, now finds itself trailing Nvidia in terms of market value, reflecting the growing importance of AI technologies over traditional consumer electronics.

This shift also highlights the competitive landscape in the semiconductor industry. Companies like AMD, Intel, and Qualcomm are closely watching Nvidia's moves, as they too seek to capitalize on the AI wave. While Nvidia currently holds a dominant position, the competition is intensifying, with rivals developing their own AI-centric solutions to challenge Nvidia's supremacy.

Nvidia's financial performance has been stellar, with the company consistently reporting strong earnings and revenue growth. In its most recent quarterly report, Nvidia posted record revenues, driven by robust sales of its data center and gaming GPUs. The company's profitability has also impressed investors, with margins expanding due to higher average selling prices and efficient cost management.

Market sentiment towards Nvidia has been overwhelmingly positive. Analysts and investors alike have lauded the company’s strategic vision and execution. The stock has seen substantial appreciation, reflecting confidence in Nvidia's growth prospects and its ability to sustain its market leadership in the AI space.

Nvidia's ascension to a $3 trillion market cap is a landmark moment for the tech industry, symbolizing the transformative potential of AI. This milestone sends a clear message about the future direction of technology, with AI poised to drive the next wave of innovation and economic growth.

For the broader tech ecosystem, Nvidia's success underscores the critical importance of investing in AI capabilities. Companies across various sectors are likely to increase their AI investments, seeking to harness the power of machine learning and automation to enhance their operations and deliver new value to customers.

Looking ahead, Nvidia is well-positioned to continue its upward trajectory. The company’s strategic focus on AI and its robust product pipeline suggest that it will remain a key player in the tech industry. Nvidia's plans to expand its AI offerings, including new chips designed specifically for AI workloads and collaborations with leading tech companies, bode well for its future growth.

However, Nvidia must navigate potential challenges, including regulatory scrutiny and geopolitical tensions that could impact its global operations. The semiconductor industry is also subject to cyclical trends, and while the current AI boom is driving demand, market conditions can change rapidly.

Some say that if there's only one company left in the world, that company's name must be Nvidia. Nvidia’s brief surpassing of a $3 trillion market cap marks a pivotal moment in the tech industry, highlighting the profound impact of AI on market dynamics and corporate valuations. As Nvidia continues to innovate and expand its AI capabilities, its role as a leader in the tech sector is likely to strengthen further. For investors, competitors, and industry stakeholders, Nvidia's rise offers valuable insights into the future trajectory of technology and the transformative power of AI.

Embark on a transformative journey in digital marketing with FoxAdvert! Seamlessly navigate through the dynamic landscape of the industry, unravel innovative growth tactics, and delve into state-of-the-art analytics solutions, all within the realm of FoxAdvert.

Enhance your online footprint alongside FoxAdvert, the eminent digital marketing powerhouse. Collaborate with our proficient squad to deliver stellar outcomes via bespoke campaigns, spanning from

paid search ads, paid social ads, Apple Search Ads, and ASO services. Attain unparalleled triumphs and drive your enterprise to new pinnacles. Initiate your journey with FoxAdvert today!